BATON ROUGE, La. – The Louisiana Department of the Treasury will begin mailing out 85,000 unclaimed property checks this month to citizens who are owed up to $1,500 each, according to State Treasurer John M. Schroder, Sr.

“All you have to do to collect this money is open up your mailbox,” said Treasurer Schroder. “You don’t have to file a claim form or submit any paperwork. We’ve done all of the work for you.”

Businesses from all over the country are required by law to report unclaimed property to the Treasury each year and provide the last known address of the owner. Sometimes, the address the company has on record is no longer correct. One of the main reasons an item becomes unclaimed property is because of an incorrect or old address.

Act 339 of the 2018 Regular Session of the Legislature by Rep. Neil Abramson permitted the Louisiana Department of Revenue to share its database of current and correct addresses with the Treasury for the sole purpose of returning unclaimed property. As a result, the Treasury was able to update the addresses it had on file and clear out a backlog of unclaimed property that was still on the books.

After cross-referencing the Louisiana Department of the Treasury’s database with the Department of Revenue’s updated addresses, 85,000 individuals who were owed $15 million were successfully matched. Recipients on this list whose claim did not exceed $1,500 can expect an official check from the Treasury sometime during the months of November and December. Citizens who are owed larger dollar amounts will be contacted to start the claims process in the near future.

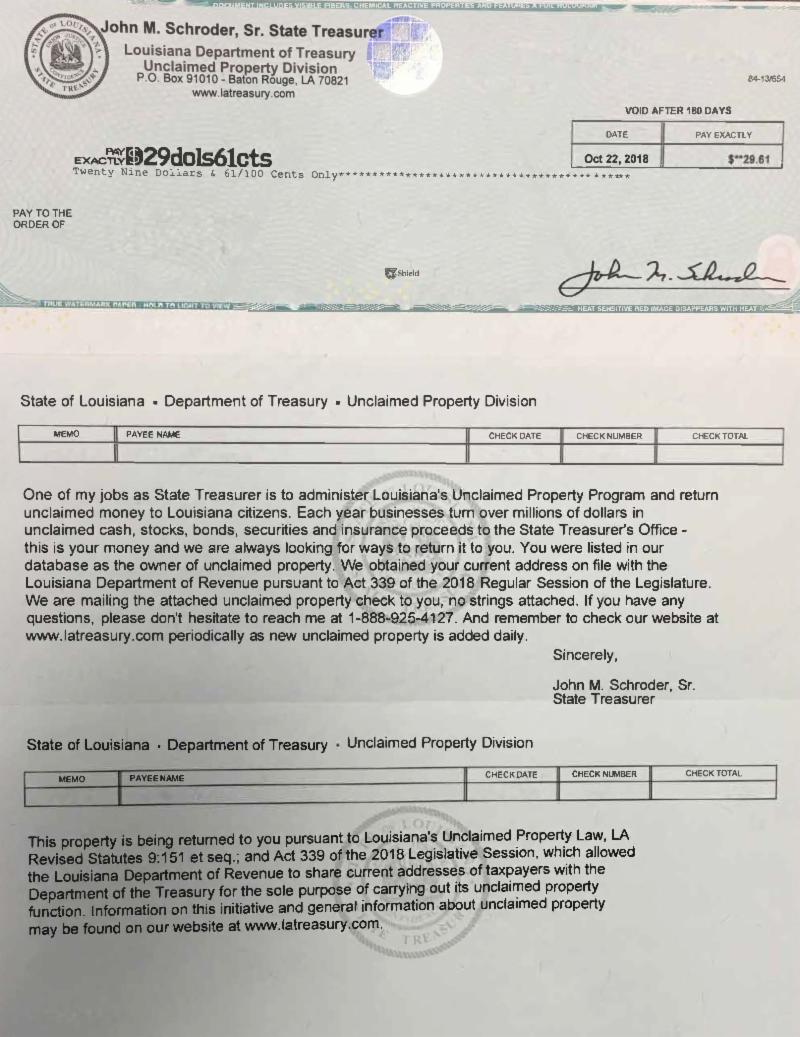

Unclaimed property refunds received in the mail will range anywhere from $10 to $1,500. Each check includes the state seal and the Unclaimed Property Division’s address and website on the top of the check. The check stub also contains a memo describing the Act 339 initiative.

The project covers five years of unclaimed property records from 2013-2017 and includes items where there were Social Security Numbers attached to names. Not all unclaimed property records have Social Security Numbers. Without one, Treasury cannot confirm the owner’s current address for this project.

“If you don’t receive a check, you may still be owed unclaimed money,” said Treasurer Schroder. “We encourage you to visit www.latreasury.com to conduct a search.”

For more information, contact the Treasury’s Unclaimed Property Division toll-free at 1-888-925-4127 (Monday – Friday 8:00 a.m. to 4:30 p.m.). Citizens can also search for their unclaimed money and file claims online at www.latreasury.com.

Here is a sample of what the official check will look like: